The Power Of The Connected World

The Connected World transforms network buying and selling through the use of location intelligence powering automated applications in order to help buyers and sellers reach better deals, faster.

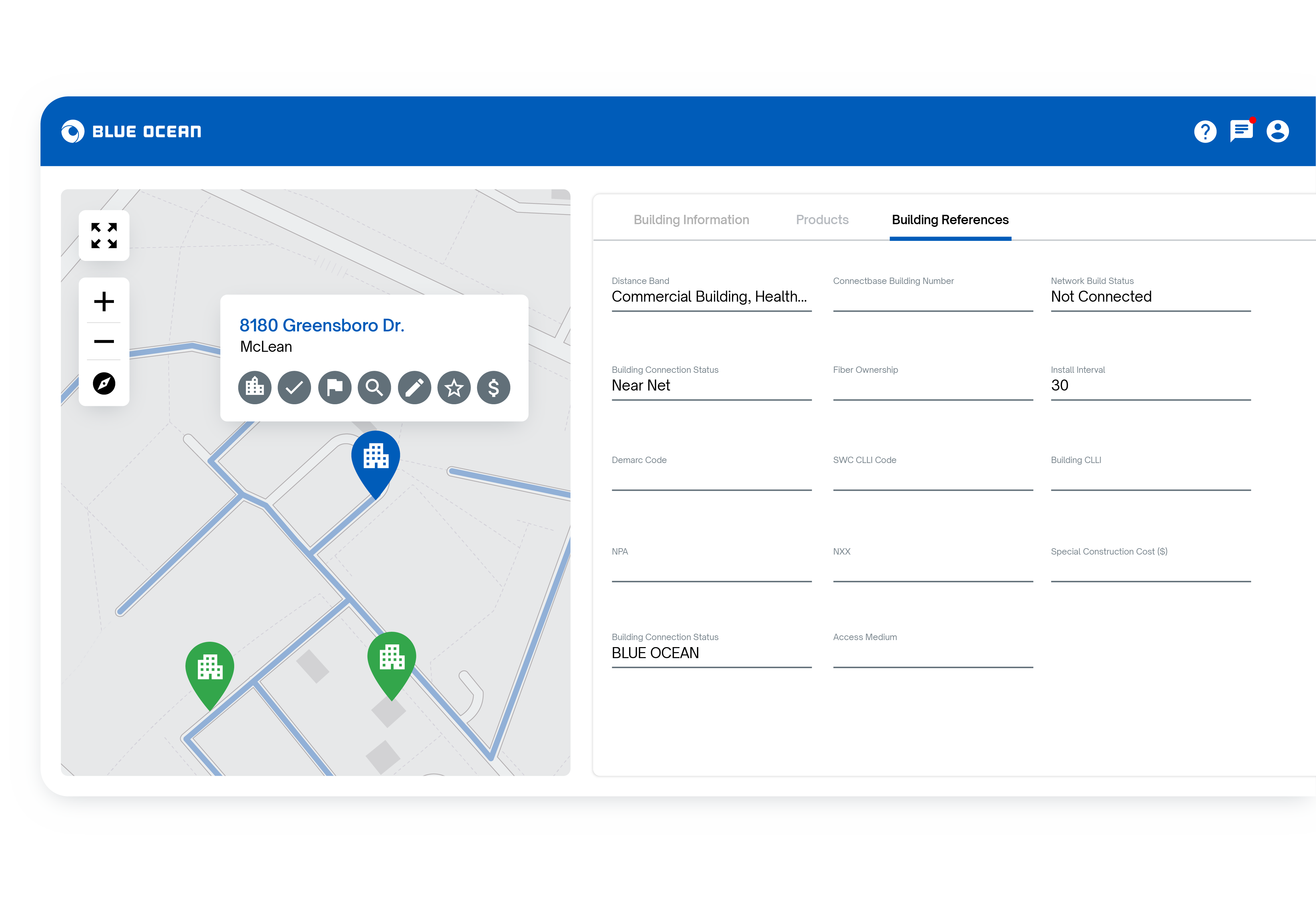

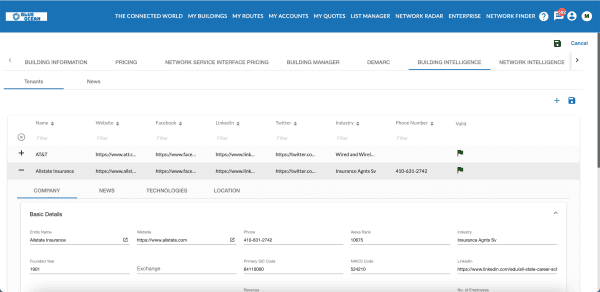

View Any Building With Market Context

With over 1.4 billion locations managed globally and counting, we leverage multiple sources of data to give you the most accurate and thorough view of any location to help you more effectively buy and sell network. Understand everything from the geographic location of the building structure to the competitive environment at the building itself to the tenants that reside in the building and more.

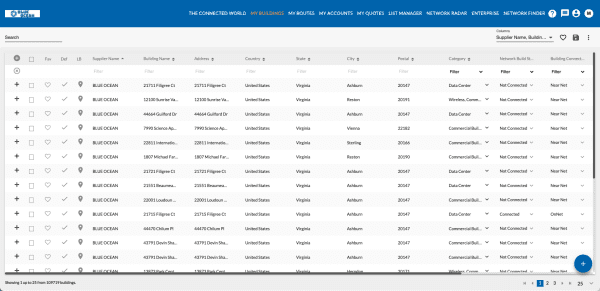

Buy And Sell Network With Ease

Manual network buying and selling processes cost your business time and money. In The Connected World, you manage all of your buying and selling activities within a single platform. From planning networks to selling them, from finding suppliers to buying from them, we automate the process to make it simple and easy for you.

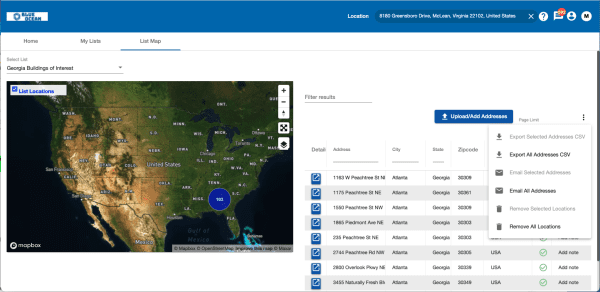

Create A System Of Record For Your Market

The Connected World acts as a system of record for your total addressable market. Beyond delivering intelligence and automation to key network buying and selling tasks, the platform is the central place to manage your market activities. Easily integrate with CRM systems, Order Management tools, and other technologies with The Connected World at the center of your market operations.

Connectbase’s location engagement platform has become an indispensable tool for various groups across Frontier. We have eliminated emails to support teams for service availability, supplying immediate availability and better partner experience.

Maggie Quinn

Director, Frontier